Your financial standing, often called net worth, is a pretty straightforward idea. It's simply the sum of everything you possess—things like money in the bank, investments, or even your home—minus all the money you owe, such as loans or credit card balances. Figuring out this number gives you a clear picture, a kind of financial snapshot, of where you are right now. It helps you see what you own and what you owe, which is, you know, a very basic but important piece of information for anyone looking to understand their money situation.

For many people, there's a natural curiosity about how their own financial situation stacks up against others. We often wonder if we're doing "well enough" or if we should be further along. This feeling, that, is quite common. Knowing your personal net worth is a good start, but comparing it to what other people, especially those around your age, have achieved can offer a different perspective. It’s not about judging, but more about gaining a broader view of financial patterns and what's typical.

This is where the idea of a "net worth percentile by age" comes into play. It helps you understand your position not just as a raw number, but in relation to a larger group. You can see, for instance, if you are among the top percentage of people your age when it comes to financial holdings, or if you are more in the middle. It’s a way to put your own financial progress into a wider context, which can be, you know, quite informative and perhaps even a bit reassuring.

Table of Contents

- What Is Net Worth, Actually?

- How Can We Figure Out Our Financial Position?

- The Typical Net Worth Percentile by Age - What Do Numbers Say?

- Is Your Net Worth Percentile by Age Where You Thought It Was?

- Tracking Your Net Worth Percentile by Age Over Time

- What Happens to Net Worth Percentile by Age as We Get Older?

- Using Tools for Your Net Worth Percentile by Age

- A Snapshot of Your Financial Picture

What Is Net Worth, Actually?

So, let's get down to what net worth really means. It's a pretty simple calculation: you take everything you own that has some sort of monetary value, and then you subtract everything you owe. What's left over is your net worth. Things you own, your assets, might include cash in your checking account, savings, investments like stocks or retirement funds, any property you might have, or even valuable items like a car. On the flip side, what you owe, your liabilities, could be student loans, a home mortgage, car payments, or credit card bills. Basically, it’s a way of summing up your financial standing at a particular moment in time, which is, you know, quite useful for financial planning.

Everyone, and I mean everyone, has a net worth number. It might be a positive number, meaning you own more than you owe, or it could be a negative number, if your debts are larger than your possessions. The point is, having this figure helps you see where you stand financially. It’s a single piece of information, but it can be really powerful because it offers a clear picture of your current financial health. You can use it to keep an eye on how you're doing over time, sort of like a score that tells you if you're making progress toward your money goals, or so it seems.

How Can We Figure Out Our Financial Position?

You might be thinking, "How do I even begin to calculate this number for myself?" Well, the good news is, it's not nearly as hard as it might sound. There are many helpful tools out there that can do the heavy lifting for you. These tools, sometimes called net worth calculators, just need you to input your assets and your liabilities, and they'll quickly give you your personal net worth figure. It's actually a very straightforward process that can be done pretty quickly, giving you a really clear idea of your financial situation.

- Babe Today

- Still Gin Lounge By Dre And Snoop Photos

- Mcdonalds Snack Wraps Coming Back

- Phoenix Tanit

- Rodeo 4

These calculators are designed to make it simple for anyone to get a handle on their money. They prompt you for the different categories of things you own and owe, so you don't have to guess or forget anything important. Using one of these free tools is a smart first step for anyone who wants to become more financially aware. It’s like getting a quick check-up for your money, and you know, it can really help you feel more in control of your financial future, which is, you know, quite a good feeling to have.

The Typical Net Worth Percentile by Age - What Do Numbers Say?

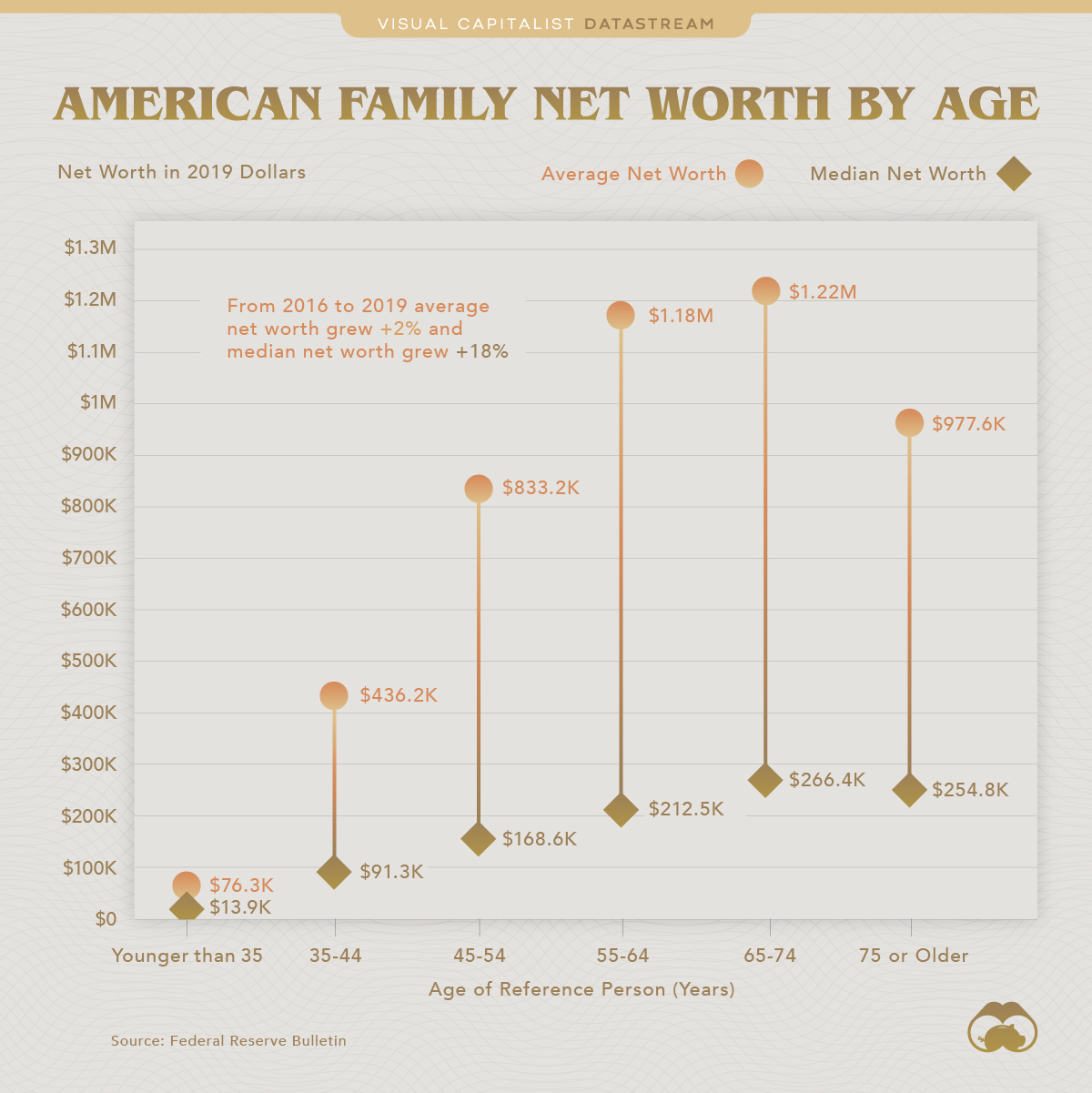

Once you have your own net worth figure, it's natural to wonder how it compares to others. This is where looking at "net worth percentile by age" becomes very interesting. For example, in 2022, the typical net worth for all Americans was about $192,900. This is what we call the median, meaning half of the people had less than this amount, and half had more. The average net worth, on the other hand, was much higher, at around $1.06 million. This larger average figure is mostly because of a few individuals who possess extremely large sums of money, which pulls the average up quite a bit, so it's almost a bit misleading if you don't consider the median.

Understanding these different numbers helps paint a fuller picture. The median gives you a sense of what's common or typical for most people, while the average can sometimes be skewed by the very wealthy. When you look at your own standing within a "net worth percentile by age" group, you get a much more refined idea of where you fit in. It's not just about a single number, but about seeing yourself within a larger group of people who are at a similar stage in their lives. This can be, you know, quite a revealing exercise for many.

Is Your Net Worth Percentile by Age Where You Thought It Was?

It's a funny thing, but many people tend to underestimate their own financial standing when they start comparing themselves to others. You might be richer than you think, in a way. This happens quite often because we tend to focus on what others seem to have, or we might compare ourselves to those who are doing exceptionally well, which isn't always a fair comparison. A "net worth percentile by age" calculator can actually show you your true rank, giving you a more accurate picture of your wealth compared to people of a similar age. It's a bit like finding out you're actually doing pretty well, even if you felt you weren't.

These tools provide a detailed breakdown of financial figures, how you stack up against others, and what makes up your financial holdings. You can see where households rank, learn about different groups of people, and gain useful ideas about your own financial spot. This can be quite empowering, as it moves you away from guessing and toward factual information. It helps you see your actual "net worth percentile by age" and perhaps realize that your financial health is stronger than you initially believed, which is, you know, a pretty good feeling.

Tracking Your Net Worth Percentile by Age Over Time

Once you've figured out your initial net worth and seen your "net worth percentile by age," the next smart step is to keep an eye on it regularly. Your financial situation isn't static; it changes as you earn more, save more, pay down debts, or even as the value of your assets shifts. Regularly tracking your net worth helps you see your progress and adjust your financial plans if needed. It's like having a financial scoreboard that updates, showing you how your efforts are paying off. This kind of ongoing check-in is, you know, a very good habit for anyone looking to improve their financial picture.

Some online platforms are specifically designed to help you calculate your net worth and keep track of it over time. They even let you publicize your net worth anonymously if you want to compare it with others without revealing your identity. This can be motivating, as you see where you stack up and how your efforts are moving you up the "net worth percentile by age" ladder. Interactive charts on these platforms can help you break down your financial holdings and see how different parts of your money picture are changing. It’s a very practical way to stay on top of your financial journey, which, you know, is quite important for long-term success.

What Happens to Net Worth Percentile by Age as We Get Older?

Generally speaking, people tend to see their net worth increase as they get older. This makes a lot of sense, really. As you age, you typically earn more money, have more time to save and invest, and often pay down larger debts like mortgages. This natural progression means that your "net worth percentile by age" might also shift over time, potentially moving you into higher groupings as you accumulate more wealth. It’s a pretty common pattern that reflects years of working, saving, and making financial choices. You'll find, too, that this trend is consistent across many different groups of people, which is, you know, quite reassuring.

Using a "net worth percentile by age" calculator specifically designed for different age brackets can be very helpful here. It allows you to see your rank not just against the general population, but against people who are at a similar stage of life. This comparison can be more meaningful and provide a clearer indication of your financial standing relative to your peers. It can also help you set realistic goals for your own financial future, seeing what's typical for someone your age and what might be possible with continued effort. So, you know, it’s a good way to gauge your progress and plan ahead.

Using Tools for Your Net Worth Percentile by Age

There are a good number of resources available to help you explore your "net worth percentile by age" in more detail. These tools often provide a full picture of financial figures, how you compare to others, and what makes up your financial holdings. They can help you explore where households stand, learn about different groups of people, and get useful ideas about your own financial spot. The goal is to give you a clear, honest look at your money situation without making it feel overwhelming. It’s, you know, about making financial awareness accessible to everyone.

If you're interested in seeing how your financial standing measures up to others in your age group, exploring a "net worth percentile by age" calculator is a very practical step. These overviews usually explain why it’s important to grasp what net worth is and how percentiles work. They can show you your rank as a percentile for your age and wealth, offering a quick way to size up your financial health. It’s a bit like getting a report card for your money, which can be, you know, very helpful for future planning and setting new financial goals.

A Snapshot of Your Financial Picture

In the end, understanding your net worth and its place within the "net worth percentile by age" gives you a powerful snapshot of your financial picture. It's a key piece of information that can help you assess your current financial health and measure your progress over time. Whether you're just starting out or have been building wealth for years, knowing this number and where you stand among your peers can provide clarity and motivation. It’s, you know, a pretty simple yet profound way to gain control and confidence about your money.

Using the available calculators and resources means you don't have to guess about your financial standing. You can get real numbers and real comparisons, which can be quite empowering. This financial literacy guide helps answer questions like "What is my net worth?" and "How can I calculate it?" By providing these answers and showing you how to use the tools, it helps you move forward with a clearer sense of your money situation. It’s all about giving you the information you need to feel more secure and make better financial choices, which, you know, is quite a valuable thing.

So, take a moment to figure out your own net worth. Use one of the free calculators. See where you stand within your "net worth percentile by age." It’s a simple step that can lead to a much deeper and more confident connection with your financial journey. This information is, you know, truly for everyone, and it can help you feel much more in charge of your financial future.

Related Resources:

Detail Author:

- Name : Eulah Quitzon III

- Username : sherman.mitchell

- Email : delfina.waelchi@hotmail.com

- Birthdate : 1972-02-11

- Address : 4549 Schinner Isle Suite 838 East Annashire, SC 13531-0970

- Phone : +1 (781) 681-3667

- Company : Mayer-Heathcote

- Job : Brazing Machine Operator

- Bio : Quaerat dolorem sit sit ex optio. Quisquam dolor optio pariatur eius omnis. Minus non aspernatur id ex. Est dignissimos eum totam illum cumque aliquid omnis. Debitis vero sapiente et cum.

Socials

twitter:

- url : https://twitter.com/heidenreich2006

- username : heidenreich2006

- bio : Ex magnam omnis placeat quia ullam dolorem sit. Vitae sed est architecto a velit dignissimos. Vel assumenda alias amet dolorem voluptatem deserunt.

- followers : 4936

- following : 435

instagram:

- url : https://instagram.com/durward_heidenreich

- username : durward_heidenreich

- bio : Rem vel expedita cum deleniti et. Quod sunt et debitis.

- followers : 685

- following : 972

tiktok:

- url : https://tiktok.com/@durward4494

- username : durward4494

- bio : Vel suscipit placeat sed molestiae.

- followers : 5256

- following : 1500