Figuring out where you stand with your money can feel a bit like trying to find your way in a big, busy city without a map. There's so much going on, and it's sometimes hard to get a clear picture of your own place within it all. That's where the idea of "net worth" comes in, offering a simple way to see your financial situation at any given moment. It’s basically a quick look at what you have versus what you owe, giving you a very personal financial score.

This number, your net worth, is more than just a figure; it’s a helpful marker on your financial path. It tells you, in a way, if you’re building up your financial strength or if there are areas that might need a little more attention. Knowing this number is the first step toward getting a better handle on your money matters, and it’s actually pretty simple to figure out, you know?

And it's not just about your own number, either. Once you have that, you can start to think about where you fit compared to others, which is where the idea of a "net worth percentile" becomes quite interesting. It gives you a sense of how your financial picture stacks up against a broader group of people, offering a different kind of perspective on your financial journey. You might be surprised by what you find, or perhaps it will confirm what you already suspected, basically.

Table of Contents

- What is Net Worth, Anyway?

- How Do You Figure Out Your Own Net Worth?

- Getting a Sense of Your Networth Percentile

- Why Care About Your Financial Picture?

- What Does Knowing Your Networth Percentile Really Show?

- Keeping Tabs on Your Net Worth

- How Tracking Helps with Your Networth Percentile Goals

- What's Next After Knowing Your Networth Percentile?

- Understanding the Nuances of Networth Percentile Data

What is Net Worth, Anyway?

At its core, net worth is a pretty straightforward concept. It's simply what you possess, like your belongings and money, minus everything you owe to others. Think of it as a financial snapshot, a picture taken at a very specific moment in time, showing your financial health. This figure gives you a clear idea of your current financial standing, which is, you know, pretty helpful for personal money management.

To break it down a bit, what you "own" are called assets. These are things that have value and could be turned into cash, or they might generate income for you. This could include the money in your savings account, any investments you have, the value of your home, or even your car. On the other side of the ledger are your liabilities, which are all the debts you have. This means things like what you still owe on your mortgage, any student loans, credit card balances, or other personal loans. So, it's a simple subtraction problem, really.

For individuals, knowing this number is a fundamental part of keeping tabs on their money. It's one piece of information you can use to watch your financial progress over time. For companies, it works the same way, giving them a quick look at their financial position. It’s a very basic, yet powerful, financial metric that everyone has, whether they realize it or not. Basically, everyone has a net worth number, even if it's a negative one.

How Do You Figure Out Your Own Net Worth?

Calculating your net worth is actually quite simple, and it doesn't take a lot of special math skills. You just need to gather up some information about your assets and your liabilities. First, list everything you own that has a monetary value. This might mean checking your bank statements for cash balances, getting an estimate for your home's worth, or looking at your investment accounts. It’s about getting a pretty good idea of what your assets add up to, you know?

Then, you list everything you owe. This includes the remaining balance on your mortgage, any car loans, student loan debt, and credit card debt. It’s important to be thorough here to get an accurate picture. Once you have these two totals, you simply subtract your total liabilities from your total assets. The result is your net worth. There are, in fact, many free calculators available online that can help you with this, making the process even easier.

These calculators often guide you through the steps, prompting you for the necessary figures. They can be a very handy tool for anyone wanting to get a quick and accurate reading of their financial standing. It’s a good idea to do this regularly, perhaps once a year, to see how things are changing. This way, you can actually track your progress and see if your financial health is improving, or if it needs some adjustments, you know?

Getting a Sense of Your Networth Percentile

Once you have your personal net worth figure, you might start to wonder, "How does my number compare to everyone else's?" This is where the concept of a "net worth percentile" comes into play. It helps you understand where your financial snapshot fits within the broader population. It’s not just about your individual number anymore; it’s about your number in relation to others, which can be quite eye-opening, basically.

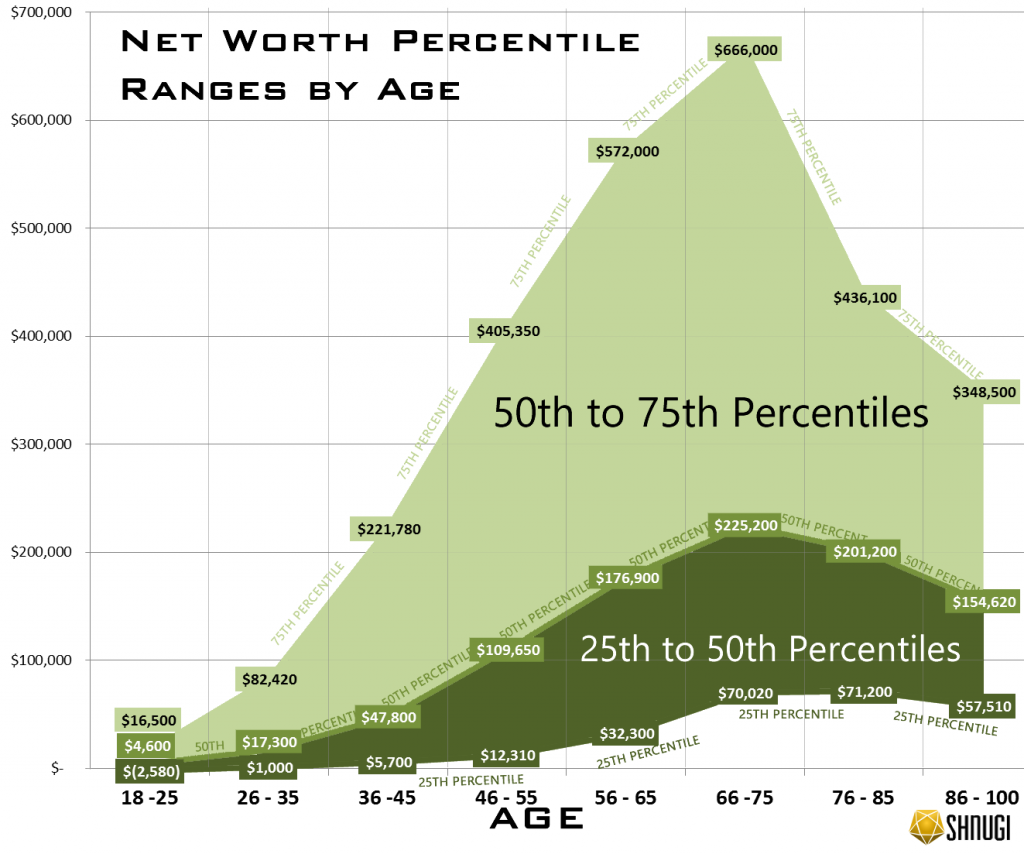

A percentile tells you what percentage of people have a net worth below yours. For instance, if you're in the 75th percentile, it means that 75% of people have a lower net worth than you do. This kind of comparison can give you a different kind of insight into your financial position. It helps you see if you're doing better than most, or if you have some catching up to do, relatively speaking.

Tools exist that allow you to anonymously input your net worth and see where you stack up. This can be a very motivating experience for some people, as it provides a benchmark. It’s a way to publicly, yet privately, compare your financial journey with others. These tools often use interactive charts, which are pretty neat, letting you slice and dice the data to see where you truly fit in terms of your networth percentile, so to speak.

Why Care About Your Financial Picture?

Knowing your net worth is a lot like having a financial compass. It doesn't just tell you where you are right now, but it also helps you figure out which way you're headed. This single data point is very useful for tracking your progress over time. If you calculate it regularly, you can see if your efforts to save more or pay down debt are actually making a difference, which is, you know, pretty encouraging.

It gives you a clear snapshot of your finances, which can help you size up your financial health. Are you building wealth, or are your debts growing faster than your assets? This number helps you measure your financial well-being in a very concrete way. It’s a personal financial report card, in a sense, that you can check whenever you want. You can use it to make better decisions about your money, too, like whether to take on more debt or focus on saving.

Beyond just tracking, understanding your financial picture can empower you to set more realistic goals. If you know your starting point, it's easier to plan where you want to go. Whether it’s saving for a down payment on a house, planning for retirement, or just building a bigger emergency fund, having a clear net worth figure provides a solid foundation for all your financial aspirations. It’s a pretty important piece of information for long-term planning, actually.

What Does Knowing Your Networth Percentile Really Show?

When you look at your net worth percentile, you're getting more than just a personal number; you're gaining a broader perspective. It helps you see how your financial efforts compare to those of others in your country or age group. For example, the median net worth for all Americans in 2022 was about $192,900. The median is the middle point, meaning half of Americans had more, and half had less. This figure gives you a pretty good idea of what's typical, you know?

On the other hand, the average net worth in 2022 was much higher, around $1.06 million. This average number can seem a bit misleading, though. It tends to be pulled way up because of a relatively small number of people who have extremely high net worths. So, while the average might look impressive, it doesn't really reflect the financial reality for most people. That's why the median figure is often a more useful benchmark for understanding your networth percentile, actually.

Knowing your net worth percentile can also help you adjust your financial expectations. If you're comparing yourself to the average and feeling discouraged, understanding that the average is skewed by a few very wealthy individuals can change your outlook. It helps you focus on realistic goals and celebrate your own progress, rather than getting caught up in comparisons that might not be fair. It’s about getting a more balanced view of your financial standing, basically.

Keeping Tabs on Your Net Worth

Keeping track of your net worth doesn't have to be a complicated chore. There are many helpful tools available, especially online, that make it quite easy to calculate your net worth and then monitor it over time. These tools can help you gather all your financial information in one place, giving you a clear and consistent picture of your assets and liabilities. It’s a bit like having a personal financial assistant, you know?

Some platforms even allow you to publicize your net worth anonymously, if you choose to. This can be a way to engage with a community, compare your numbers with others, and see where you stack up without revealing your identity. It's a pretty unique feature that can add a social element to personal finance, letting you learn from others' experiences and strategies. You can, in some respects, find motivation by seeing how others manage their money.

These online trackers often come with interactive charts and graphs, which can visualize your financial progress. You can see trends, identify areas where you're doing well, and spot places where you might need to make some changes. This visual feedback can be very powerful in keeping you motivated and engaged with your financial goals. It makes the process of tracking your money much more dynamic and interesting, honestly.

How Tracking Helps with Your Networth Percentile Goals

Regularly tracking your net worth is a key habit for anyone serious about improving their financial situation. When you consistently update your numbers, you create a historical record of your financial journey. This record is incredibly valuable because it shows you the direct impact of your financial decisions. If you've been working hard to pay off debt, you'll see your liabilities shrink, and your net worth grow, which is very rewarding.

This consistent tracking also helps you set more informed goals for your networth percentile. If you know you're currently in the 30th percentile, and you want to reach the 50th, you can then set specific financial targets to get there. It gives you a clear objective to work towards, rather than just vaguely hoping to improve your financial standing. It provides a concrete way to measure your progress against a broader benchmark, basically.

Furthermore, seeing your net worth change over time can help you identify patterns in your spending and saving habits. You might notice that certain months or years see bigger jumps in your net worth, prompting you to understand why that happened. This insight can help you repeat successful strategies and avoid those that hinder your progress. It's a powerful feedback loop that can really help you refine your financial approach, you know?

What's Next After Knowing Your Networth Percentile?

Once you have a good grasp of your net worth and where you stand in terms of your net worth percentile, the next natural question is often, "What do I do with this information?" It’s not just about having the number; it’s about using it to make smart choices for your financial future. This financial literacy guide can help answer these and other important personal finance questions, helping you move forward with confidence, honestly.

Knowing your net worth is a starting point for setting meaningful financial goals. If your net worth is lower than you'd like, you might focus on reducing debt or increasing your savings. If it's growing steadily, you might look into more advanced investment strategies. It provides a baseline from which you can plan your next steps, whether they involve increasing your income, cutting expenses, or optimizing your investments. It’s a pretty solid foundation for financial planning, actually.

This knowledge also helps you understand the broader economic landscape and how it might affect your personal finances. For example, if you see that the median net worth is rising, it might indicate a generally improving economy, which could influence your own financial decisions. It helps you connect your personal financial situation to the bigger picture, giving you a more complete view of your money matters, so to speak.

Understanding the Nuances of Networth Percentile Data

While looking at your net worth and its percentile can be very informative, it’s also good to remember that these figures are just snapshots. They represent your financial situation at one specific moment. Life changes, and so will your net worth. It’s one data point you can use to track your progress, but it doesn't tell your whole financial story. There are always other factors at play, you know?

For instance, a young person just starting their career might have a low or even negative net worth due to student loans, but they have many years ahead to build wealth. Conversely, someone nearing retirement might have a high net worth but also significant expenses coming up. The net worth percentile provides a comparison, but it doesn't account for individual life stages or unique circumstances, which are, you know, pretty important considerations.

So, while it’s a powerful tool for self-assessment and comparison, it's always best to view your net worth and its percentile as part of a larger financial picture. It helps you size up your financial health and measure your progress, but it’s not the only measure of your financial well-being. It’s a helpful guide, but not the only map, basically, for your financial journey.

Related Resources:

Detail Author:

- Name : Maximillia Jaskolski V

- Username : etha.stokes

- Email : qbernier@kshlerin.com

- Birthdate : 1985-11-22

- Address : 7588 Montana Gardens Conniemouth, MA 63081

- Phone : +1-408-207-2749

- Company : Jast, Gusikowski and Schmitt

- Job : Metal-Refining Furnace Operator

- Bio : Ut numquam a rerum dolorum. Neque iusto rerum vitae iusto accusamus ut asperiores placeat. Est aspernatur voluptas enim provident sunt quod eaque. Rem aperiam qui suscipit natus aut.

Socials

linkedin:

- url : https://linkedin.com/in/missouriwitting

- username : missouriwitting

- bio : Et rerum eligendi nisi quaerat tenetur.

- followers : 328

- following : 730

facebook:

- url : https://facebook.com/missouri_dev

- username : missouri_dev

- bio : Illo sunt et veritatis non esse. Vel est hic rem autem.

- followers : 1575

- following : 1627

tiktok:

- url : https://tiktok.com/@wittingm

- username : wittingm

- bio : Dolor voluptates fuga et corrupti delectus aut.

- followers : 3082

- following : 343